One of the most crucial tools allowing real estate investors to sift through dozens of proposed transactions is the infamous back-of-the-envelope (BOE) analysis. By definition, the BOE is an informal mathematical computation that uses numerical estimations to quickly develop a ‘ballpark figure’. BOE calculations are often used in real estate to determine whether further research and more detailed calculations are warranted.

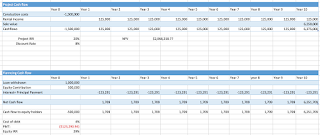

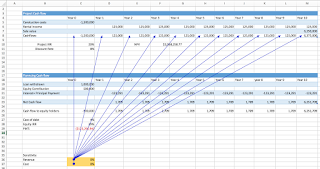

So, how does the BOE calculation work? Well, it considers the net cash flow of a proposed project and its cap rate. Generally speaking, you will need to make five simple assumptions before commencing the calculation: (i) Purchase price- or initial investment (ii) Rental income- per month or annually (iii) Down payment (iv) Loan amount and term, and (v) Monthly repayment- or amortisation.To illustrate, let’s assume you’re considering investing in a property worth $300,000 and would generate rental income of $595 a week or $2,550 a month. You pay 110,000, borrow $190,000 at 3% a month for 30 years and pay $807 a month.

1) Calculate the annual rent, which is simply the monthly rent multiplied by twelve.

2,550*12= 30,600

2) Calculate cash flow before financing, which is the annual rent (from step 1) multiplied by the operating expenses (let's assume that our operating expenses are 20% here, including property management cost, repair fees, and amenities fees).

30,600*0.80= 24,480

3) Calculate the annual cost of financing, simply the monthly repayment times twelve.

807*12= 9,693

24,480-9,693= $14,786

after you've completed the above calculations, now you need to compute some key metrics. There are three key metrics that will determine whether a potential investment is worthy: return on asset, cost of financing and return on equity.

Return on asset: Cash flow before financing/price of the property

24,480/300,000= 8%

This is also known as the cap rate. It simply tells you the rate of return the property would produce if you owned it without obtaining a loan/financing.

Cost of financing= annual cost of financing/ loan amount

9,693/190,000= 5%

We usually calculate this figure to compare it to the return on asset figure. If your return on assets is higher than your cost of financing that means you have a positive leverage (which in this case, we do!). In less formal terms, you’re using the bank’s money to generate higher returns than what it cost you to obtain the money.

Return on Equity: cash flow after financing/ equity payment

14,786/ 110,000= 13%

This tells you what your invested equity is earning. When you achieve positive leverage, your return on equity will be higher than your return on assets. Again, in less formal terms, you are earning a higher return by using the bank’s money to finance part of the purchase.

Completing this analysis for the first time might seem time-consuming, but after a couple of tries you get used to it and it becomes a powerful skill to have as a property investor.

After you’ve run the initial analysis (on Excel maybe), you realise how specifically useful this technique is as it allows you to quickly evaluate potential scenarios (think of it as a short-sensitivity analysis). For example, it’ll help you answer questions as ‘what if I borrowed $240,000 for the property instead?’ and ‘how will my returns look if I am able to secure a longer loan period, let’s say 40 years instead’.

In conclusion, the BOE calculation is an approximation method that provides some insight on potential investment projects and NOT a substitute for a fully-fledged analysis. Running the BOE analysis within 5 minutes can give you critical information to decide on which projects are worth looking further into.